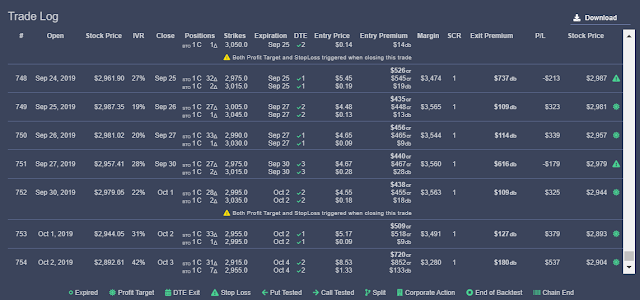

One thing that makes backtest difficult is when you have tight profit target and stoploss at the same time. When intraday volatility is high, both criteria are going to be triggered and you have no idea which one occurs first unless you have short interval intraday data (< 1 min). In eDeltaPro's latest update, they incorporated a warning "Both Profit Target and StopLoss triggered when closing this trade" in the trade log (see the screenshot below). This information is very useful as it will tell you how reliable the backtest result is. In this current update, profit target is executed for calculating the final P/L so this will give you the best case scenario. I have been talking to Leo at eDeltaPro to see if it is possible to set making stoploss being executed as an option. It will then give us the worse case scenario for those trades which trigger both profit target and stoploss. It is a good way to circumvent the issue and gives you a better idea what the reality of your strategy is, in which the performance should be in between the best and worse case scenarios.

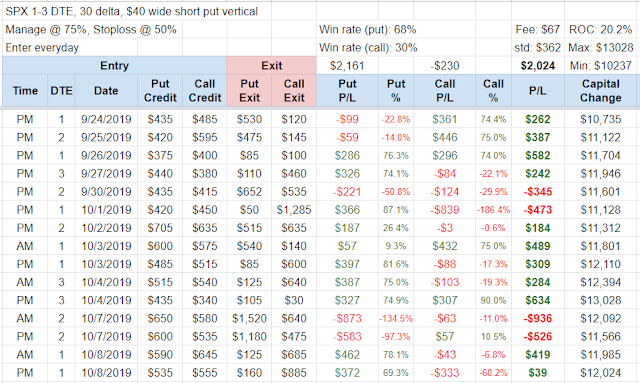

I talked about 1-3 DTE short put vertical strategy (see the article here). It has been a profitable strategy based on my paper trading. Since the strategy has a tight profit target (75%) and stoploss (40%), the backtest P/L will be overestimated. I also backtested the short call vertical with the same criteria (1-3 DTE, 75% profit target, 40% stoploss). It is as profitable as the put strategy. Of course we don't know how often the two early exit criteria are triggered so the result will not be accurate and I am not going to show them here. If we incorporate short call vertical, the strategy is basically an iron condor but manage both wings differently. As usual, to know if this is a profitable strategy, you have to trade it to know the answer. I have been paper trading it for a while. I also need to trade it with real money. After all the order execution might be very different between the real and paper.

The test condition: 1-3 DTE 30 delta short iron condor at open and at close, manage two wings separately @ 75% and stoploss @ 50% (I use a higher stoploss % hoping for a less touching rate). Once I enter the position, I set up a GTC order to close it using OCO bracket. Below is my trade log for paper trading. The big loss for the call on 10/1 is unusual. The market gaps down the next day so the call should make money. It is either the execution issue for paper money or the issue of market order for stoploss. I need to see if that happens with real money. If you take out that weird big loss the calls are profitable. I changed stoploss % recently. It was 20% for calls initially. We will see how it goes.

Analyzing low-maintenance mechanical option trading strategies based on backtests, aiming on high return on capital, smooth P/L curve, and executable in real life.

Wednesday, October 9, 2019

Sunday, September 8, 2019

Should we manage losers? 1-3 DTE strategy

One of the most promoted trading philosophy in Tastytrade - managing winners - is important to increasing win rate in your trading. It is particularly important for long DTE strategies. You can even get close to 100% win rate by managing very early (see 100% win rate strategy). One of the issues for long DTE strategy is the potential high volatility of the position, meaning the position may incur very high unrealized loss at some point. This is a psychological hurdle to prevent inexperienced traders from execution the trading plan thoroughly. You can even get margin call very easily without a proper capital management.

The bottom of the result is the bar graph for every P/L. Note there are some big losers which are resulted from overnight gap down. Trade exit takes account the intraday high and low price. This backtest is based on mid-price. We all know you can't always get filled at mid price. The result is still pretty good if using the market price:

Backtests show narrower stop gives better performance in terms of total P/L, ROC, STD, but not win rate. If you don't have stoploss in this strategy the performance becomes terrible. Again, win rate in my opinion is the least thing to consider in mechanical trading. After all every trader likes to have good return on least possible capital. I don't care how to get there.

How about another extreme as opposed to long DTE? The backtest shows SPX 1-3 DTE 30 delta short put vertical, $40 wide, manage at 75%, stop at 40%, enter everyday gives very promising ROC for the past 5 years.

The bottom of the result is the bar graph for every P/L. Note there are some big losers which are resulted from overnight gap down. Trade exit takes account the intraday high and low price. This backtest is based on mid-price. We all know you can't always get filled at mid price. The result is still pretty good if using the market price:

I used 40% stop loss here. How about different stop percentage?

Backtests show narrower stop gives better performance in terms of total P/L, ROC, STD, but not win rate. If you don't have stoploss in this strategy the performance becomes terrible. Again, win rate in my opinion is the least thing to consider in mechanical trading. After all every trader likes to have good return on least possible capital. I don't care how to get there.

Now, the biggest question is how reliable and executable this backtest is. For any strategies that use stop loss, I use stop market order for paper trading because it will prevent you from not executing the order due to slippage (I have been told even using stop market it is still not 100% execution rate). $40 wide means your risk is almost $4000. You want to make sure you get out of the trade if the market hits the stop price. I have several occasions where my stop limit order is not get executed.

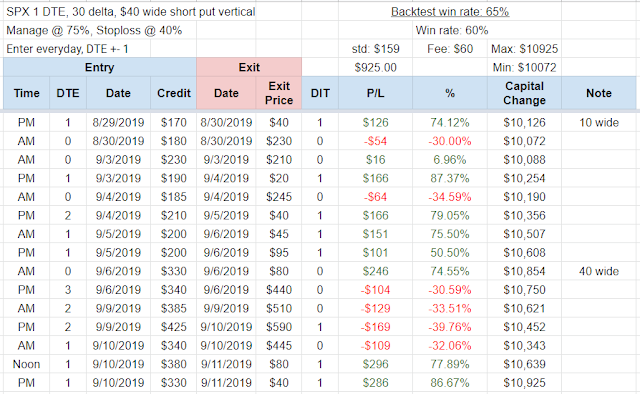

Below is my paper money trade log for this strategy. I initially used $10 wide and I figured $40 wide is more profitable. AM, PM means enter at open and at close, respectively. eDeltaPro only allows you to enter the trade 15 min before close. I don't think there will be a significant difference between entry times. It might be a way to diversify entry point though. I will keep updating the trade log. This is the only way to verify the backtest result.

**I recently changed the strategy. The updated version can be found here.

Below is my paper money trade log for this strategy. I initially used $10 wide and I figured $40 wide is more profitable. AM, PM means enter at open and at close, respectively. eDeltaPro only allows you to enter the trade 15 min before close. I don't think there will be a significant difference between entry times. It might be a way to diversify entry point though. I will keep updating the trade log. This is the only way to verify the backtest result.

**I recently changed the strategy. The updated version can be found here.

Tuesday, August 20, 2019

Backtest platform - eDeltaPro

--Disclaimer-- I do not receive any compensation from eDeltaPro. This article is based on my personal opinion.

Want to share a very powerful option backtest platform - eDeltaPro. It can backtest almost every mechanical strategy. You can set many parameters such as profit target, stoploss, DTE, rolling, etc. Backtest is supposed to help you to understand your strategy better. In the end of the day, it is still up to your execution ability and trading psychology. If you decide to trade using a mechanical strategy, you have to keep trading it no matter what. You get what the market gives you.

https://www.edeltapro.com/

Before using a backtest platform to evaluate your strategy, you need to consider the following points:

1. Know your product. For example, SPX does not have weekly options until Oct 2005, Monday-expiring options started in Aug 15, 2016, and Wednesday-expiring options started in Feb 23, 2016. So you have much less data points in the past than it is now. The backtest result means differently in the past 3 years vs. 5 years vs. 10 years, etc.

2. I believe every backtest platform only uses EOD data so the result will be much different if you were to enter/exit your position intraday, basically strategies that involve profit target and stoploss .

3. Past result does not guarantee the future performance. Don't be obsessed or over-thinking/explaining the backtest result too much. No one knows what the market will be like in the future. It could be a completely different environment that has never happened before. Sometimes you just get lucky having a good backtest result. For example, you can choose to enter a position everyday and set up the maximum number of simultaneous open position. If you choose to trade daily with long DTE with small maximum open positions, you will skip a lot of trading days. If it is a short put strategy you might just skip the really bad down days of the year and you happen to get great result. But that does not tell you how resilient your strategy is during big selloffs.

Here is an example of Tastytrade's favorite strategy, SPY short naked put 16 delta 45 DTE manage @ 50% and 21 DTE, 12 yr, including commission (Tastyworks rate). It shows that this is a profitable strategy. But if you look at the green trace (unrealized P/L), there is a $10,000 drawdown in the end of 2018. That is where most people give up and decide to take the loss (or get margin call). This is a good example showing why it doesn't matter if you find a profitable strategy from backtest because the problem is execution. Most people will bail out during big loss days. However, this result does not guarantee that you won't see a bigger drawdown in the future. It just tells you the biggest drawdown is 13.7% with this strategy in the past 12 years.

For an ideal strategy, you should be looking for a smooth P/L curve. For example, 60 delta short strangle managed @10% looks very promising. But you do need a lot of capital to do that. The capital req. showed in the picture is the lowest starting capital. The program will fully utilize BP including the profit. One thing to note is that this strategy only gives you 300% ROC (return on capital) over 12 years and this is the maximum ROC you can get since it fully utilizes the capital. 300% ROC over 12 years I would rather just buy and hold SPY. ROC is a big thing to consider. I would argue if your strategy does not give you a better ROC than holding SPY, it is not worth the effort to execute it.

To summarize, backtest can quickly tell you if one strategy has potential or not as well as help you to understand what to expect with the strategy (like potential consecutive losses, etc). It does have limitations if you want to incorporate more complex defense strategies. I personally use it to educate myself.

Want to share a very powerful option backtest platform - eDeltaPro. It can backtest almost every mechanical strategy. You can set many parameters such as profit target, stoploss, DTE, rolling, etc. Backtest is supposed to help you to understand your strategy better. In the end of the day, it is still up to your execution ability and trading psychology. If you decide to trade using a mechanical strategy, you have to keep trading it no matter what. You get what the market gives you.

https://www.edeltapro.com/

Before using a backtest platform to evaluate your strategy, you need to consider the following points:

1. Know your product. For example, SPX does not have weekly options until Oct 2005, Monday-expiring options started in Aug 15, 2016, and Wednesday-expiring options started in Feb 23, 2016. So you have much less data points in the past than it is now. The backtest result means differently in the past 3 years vs. 5 years vs. 10 years, etc.

2. I believe every backtest platform only uses EOD data so the result will be much different if you were to enter/exit your position intraday, basically strategies that involve profit target and stoploss .

3. Past result does not guarantee the future performance. Don't be obsessed or over-thinking/explaining the backtest result too much. No one knows what the market will be like in the future. It could be a completely different environment that has never happened before. Sometimes you just get lucky having a good backtest result. For example, you can choose to enter a position everyday and set up the maximum number of simultaneous open position. If you choose to trade daily with long DTE with small maximum open positions, you will skip a lot of trading days. If it is a short put strategy you might just skip the really bad down days of the year and you happen to get great result. But that does not tell you how resilient your strategy is during big selloffs.

Here is an example of Tastytrade's favorite strategy, SPY short naked put 16 delta 45 DTE manage @ 50% and 21 DTE, 12 yr, including commission (Tastyworks rate). It shows that this is a profitable strategy. But if you look at the green trace (unrealized P/L), there is a $10,000 drawdown in the end of 2018. That is where most people give up and decide to take the loss (or get margin call). This is a good example showing why it doesn't matter if you find a profitable strategy from backtest because the problem is execution. Most people will bail out during big loss days. However, this result does not guarantee that you won't see a bigger drawdown in the future. It just tells you the biggest drawdown is 13.7% with this strategy in the past 12 years.

For an ideal strategy, you should be looking for a smooth P/L curve. For example, 60 delta short strangle managed @10% looks very promising. But you do need a lot of capital to do that. The capital req. showed in the picture is the lowest starting capital. The program will fully utilize BP including the profit. One thing to note is that this strategy only gives you 300% ROC (return on capital) over 12 years and this is the maximum ROC you can get since it fully utilizes the capital. 300% ROC over 12 years I would rather just buy and hold SPY. ROC is a big thing to consider. I would argue if your strategy does not give you a better ROC than holding SPY, it is not worth the effort to execute it.

To summarize, backtest can quickly tell you if one strategy has potential or not as well as help you to understand what to expect with the strategy (like potential consecutive losses, etc). It does have limitations if you want to incorporate more complex defense strategies. I personally use it to educate myself.

7 DTE Strategy

Let's talk about 7 DTE strategy.

Interestingly, when I do 50% stoploss, the drawdown becomes much smaller. In exchange you get only 62% win rate but better ROC and total P/L. It is noted that in the worse period of time there is 15 consecutive losses (so are other stoplosses). Are you willing to stay engaged when you get more than 10 consecutive losses?

I shared this briefly in commenting someone's post. I'd like to share more details about what I found from backtesting 7 DTE strategy. I would like to address two points beforehand so you can understand backtest better.

Backtesting an early exit strategy (profit target and stoploss) is problematic because of intraday fluctuation and overnight gap up/down. If you only use EOD data your backtest result will be far off (which is basically the main problem for every backtest platform). The backtest platform I am using offers these two options: check execute vs open price (to include gap up/down) and check execution vs high & low (to be able to exit intraday). With these two options, the backtest result will be more reliable.

One issue that is hard to verify is the daily high&low price. Since the daily high&low prices are based on actual transaction. So if a certain strike has a very low volume, the price would not be that reliable. That means the prices for low volume strikes don't move much with the stock price. I hope they can include theoretical price for high&low prices.

OK, let's see the result. The test condition is 7 DTE (+-1) SPY short 30 delta put vertical with $40 wide long leg, stopped at 100, 200, and 300% loss. The trade was entered everyday for the past 3 years. You might wonder why I only test for 3 year. It is because SPY has much less expiration to select from 2-3 years ago. You can't enter a trade everyday in older times. This is a profitable strategy for the past 3 years. However, there is a very strong psychological hurdle for this strategy as indicated. The drawdown in 2018 is too much. I would not want to see my one year worth profit go away in just several months. Imagine you trade this strategy for one year and your return is negative. How bad is that?

OK, let's see the result. The test condition is 7 DTE (+-1) SPY short 30 delta put vertical with $40 wide long leg, stopped at 100, 200, and 300% loss. The trade was entered everyday for the past 3 years. You might wonder why I only test for 3 year. It is because SPY has much less expiration to select from 2-3 years ago. You can't enter a trade everyday in older times. This is a profitable strategy for the past 3 years. However, there is a very strong psychological hurdle for this strategy as indicated. The drawdown in 2018 is too much. I would not want to see my one year worth profit go away in just several months. Imagine you trade this strategy for one year and your return is negative. How bad is that?

Interestingly, when I do 50% stoploss, the drawdown becomes much smaller. In exchange you get only 62% win rate but better ROC and total P/L. It is noted that in the worse period of time there is 15 consecutive losses (so are other stoplosses). Are you willing to stay engaged when you get more than 10 consecutive losses?

So, which is more important? Winning rate? P/L curve? or return on capital (ROC)? In my opinion, I would like to have high ROC, otherwise I can just buy SPY and leave it alone. SPY gives 34% ROC for the past 3 years and this strategy offers 81%. But you won't put just enough money to do short strategy, if you use 50% required capital the ROC becomes 41%, kind of similar to buy and hold SPY stock but you get a much smoother P/L curve using this strategy. I would like to see how this strategy performs in a recession but unfortunately there is not enough data in 2008 to test that out. Since I still have concern about high&low price data, I will trade it to figure out how reliable this backtest is.

100% win rate strategy?

100% win rate strategy? Is it possible?

According to backtest (2010-2019), if you keep selling 120 DTE (+-5) 20 delta naked strangle on SPY (5 max active positions), managed at 5% credit received, and no stoploss, you win 605 times out of 605 trades. It is no doubt a winning strategy but it is a difficult strategy to execute. For example, the drawdown circled in red (unrealized P/L) in late 2011 is a psychological stop for most traders. This is one of the "one big loss wipes out all profit" scenarios. If it happens, you might keep thinking premium selling is too risky and stop doing it. So you need to know what your risk tolerance is.

The good part of this strategy is the long DTE. It gives you more time to be right. It is noted that all losing positions happen to recover within 120 days in the test period. Will it be a trade that never recovers? Yes, might be sometimes in the future. It is just the odd of that to happen is small but not zero. One thing that is worth mentioning is that this strategy can live through volatile 2018 which is pretty impressive to me. Since naked strategy is high risk, I would make sure I have 5-10x of the required capital in my account before trading strategies like it. Again, 215% since 2010 is not so promising. You get similar ROC if you buy and hold SPY.

P.S. 1: I really want to see how this strategy does in 2008 but there is lack of data for either selected DTE or delta before 2010.

According to backtest (2010-2019), if you keep selling 120 DTE (+-5) 20 delta naked strangle on SPY (5 max active positions), managed at 5% credit received, and no stoploss, you win 605 times out of 605 trades. It is no doubt a winning strategy but it is a difficult strategy to execute. For example, the drawdown circled in red (unrealized P/L) in late 2011 is a psychological stop for most traders. This is one of the "one big loss wipes out all profit" scenarios. If it happens, you might keep thinking premium selling is too risky and stop doing it. So you need to know what your risk tolerance is.

The good part of this strategy is the long DTE. It gives you more time to be right. It is noted that all losing positions happen to recover within 120 days in the test period. Will it be a trade that never recovers? Yes, might be sometimes in the future. It is just the odd of that to happen is small but not zero. One thing that is worth mentioning is that this strategy can live through volatile 2018 which is pretty impressive to me. Since naked strategy is high risk, I would make sure I have 5-10x of the required capital in my account before trading strategies like it. Again, 215% since 2010 is not so promising. You get similar ROC if you buy and hold SPY.

P.S. 2: If you don't limit the max active position, it still has 100% win rate (881/881) but the required capital becomes $32,438.

Subscribe to:

Comments (Atom)