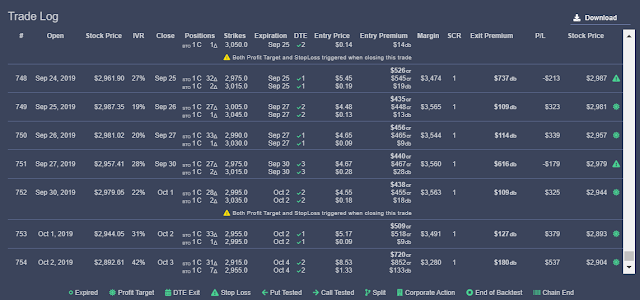

One thing that makes backtest difficult is when you have tight profit target and stoploss at the same time. When intraday volatility is high, both criteria are going to be triggered and you have no idea which one occurs first unless you have short interval intraday data (< 1 min). In eDeltaPro's latest update, they incorporated a warning "Both Profit Target and StopLoss triggered when closing this trade" in the trade log (see the screenshot below). This information is very useful as it will tell you how reliable the backtest result is. In this current update, profit target is executed for calculating the final P/L so this will give you the best case scenario. I have been talking to Leo at eDeltaPro to see if it is possible to set making stoploss being executed as an option. It will then give us the worse case scenario for those trades which trigger both profit target and stoploss. It is a good way to circumvent the issue and gives you a better idea what the reality of your strategy is, in which the performance should be in between the best and worse case scenarios.

I talked about 1-3 DTE short put vertical strategy (see the article here). It has been a profitable strategy based on my paper trading. Since the strategy has a tight profit target (75%) and stoploss (40%), the backtest P/L will be overestimated. I also backtested the short call vertical with the same criteria (1-3 DTE, 75% profit target, 40% stoploss). It is as profitable as the put strategy. Of course we don't know how often the two early exit criteria are triggered so the result will not be accurate and I am not going to show them here. If we incorporate short call vertical, the strategy is basically an iron condor but manage both wings differently. As usual, to know if this is a profitable strategy, you have to trade it to know the answer. I have been paper trading it for a while. I also need to trade it with real money. After all the order execution might be very different between the real and paper.

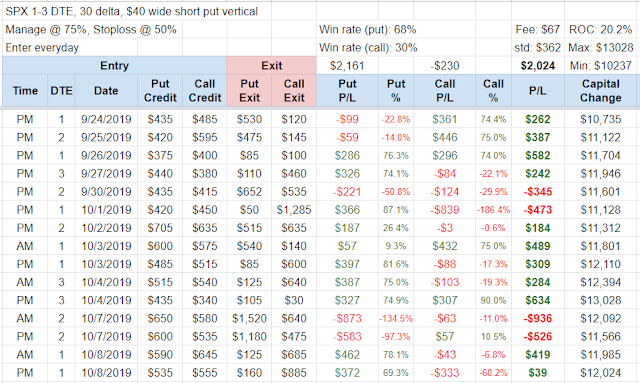

The test condition: 1-3 DTE 30 delta short iron condor at open and at close, manage two wings separately @ 75% and stoploss @ 50% (I use a higher stoploss % hoping for a less touching rate). Once I enter the position, I set up a GTC order to close it using OCO bracket. Below is my trade log for paper trading. The big loss for the call on 10/1 is unusual. The market gaps down the next day so the call should make money. It is either the execution issue for paper money or the issue of market order for stoploss. I need to see if that happens with real money. If you take out that weird big loss the calls are profitable. I changed stoploss % recently. It was 20% for calls initially. We will see how it goes.

No comments:

Post a Comment