How about another extreme as opposed to long DTE? The backtest shows SPX 1-3 DTE 30 delta short put vertical, $40 wide, manage at 75%, stop at 40%, enter everyday gives very promising ROC for the past 5 years.

The bottom of the result is the bar graph for every P/L. Note there are some big losers which are resulted from overnight gap down. Trade exit takes account the intraday high and low price. This backtest is based on mid-price. We all know you can't always get filled at mid price. The result is still pretty good if using the market price:

I used 40% stop loss here. How about different stop percentage?

Backtests show narrower stop gives better performance in terms of total P/L, ROC, STD, but not win rate. If you don't have stoploss in this strategy the performance becomes terrible. Again, win rate in my opinion is the least thing to consider in mechanical trading. After all every trader likes to have good return on least possible capital. I don't care how to get there.

Now, the biggest question is how reliable and executable this backtest is. For any strategies that use stop loss, I use stop market order for paper trading because it will prevent you from not executing the order due to slippage (I have been told even using stop market it is still not 100% execution rate). $40 wide means your risk is almost $4000. You want to make sure you get out of the trade if the market hits the stop price. I have several occasions where my stop limit order is not get executed.

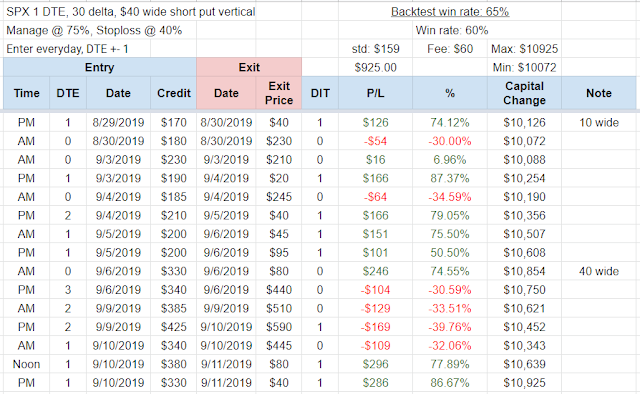

Below is my paper money trade log for this strategy. I initially used $10 wide and I figured $40 wide is more profitable. AM, PM means enter at open and at close, respectively. eDeltaPro only allows you to enter the trade 15 min before close. I don't think there will be a significant difference between entry times. It might be a way to diversify entry point though. I will keep updating the trade log. This is the only way to verify the backtest result.

**I recently changed the strategy. The updated version can be found here.

Below is my paper money trade log for this strategy. I initially used $10 wide and I figured $40 wide is more profitable. AM, PM means enter at open and at close, respectively. eDeltaPro only allows you to enter the trade 15 min before close. I don't think there will be a significant difference between entry times. It might be a way to diversify entry point though. I will keep updating the trade log. This is the only way to verify the backtest result.

**I recently changed the strategy. The updated version can be found here.

No comments:

Post a Comment